Banks introduce fees on large deposits to meet lending targets, avert tax

Pakistani banks have started charging fees on large savings accounts to meet the government’s advance-to-deposit ratio (ADR) requirement and avoid additional taxes.

The move is part of a broader strategy to boost private sector lending amid mounting financial pressures. The first bank to do so was Bank Al Falah, which announced the monthly fee on November 15.

Other banks quickly followed, with Habib Bank Limited (HBL) and Bank of Punjab (BoP) announcing similar fees on 18 November.

Meezan Bank Ltd., Pakistan’s largest lender by profitability, announced a 5% monthly fee on savings accounts holding more than 1 billion rupees ($3.6 million).

“Meezan Bank reserves the right to charge a monthly fee of 5% on deposit accounts where the account balance on the last day of the month is PKR 1 billion and above (or equivalent in case of foreign currency),” read a notice. Issued by the bank.

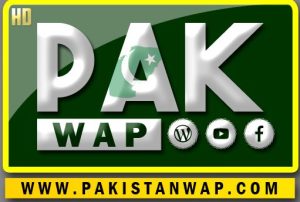

MCB Bank Limited has said in a notice that 5% monthly fee will be applicable on all checking accounts (savings and current accounts) with a balance of PKR 3 billion or more (or equivalent in case of foreign currency). Until the last day. of the month

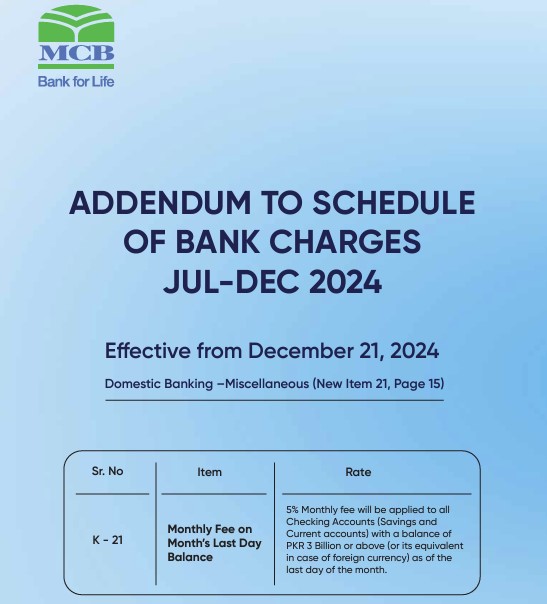

Faisal Bank said that a 5% monthly fee will be charged on all checking accounts, including local and foreign currency accounts, with balances of Rs 5 billion or more (or its equivalent in foreign currency) per month. Finally.

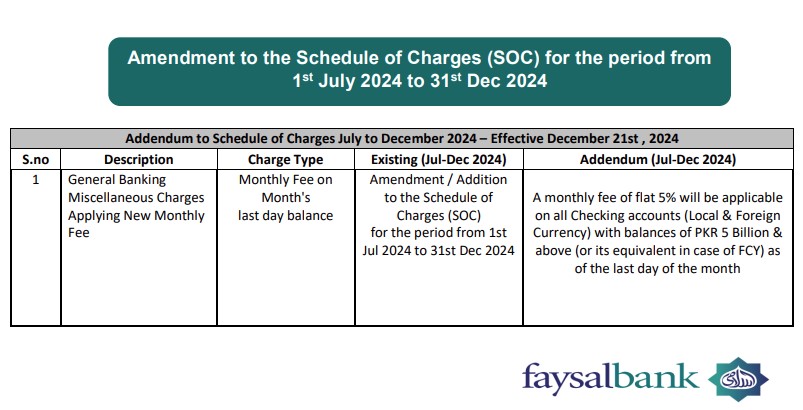

Askari Bank revealed that a flat 5% monthly fee will apply to all checking accounts with a balance of Rs 1 billion or more (or its equivalent in foreign currency) as of the last day of the month.

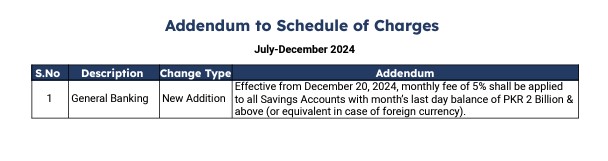

JS Bank announced that a 5% monthly fee, effective from 20 December 2024, will be levied on all savings accounts with a balance of PKR 2 billion or more (or foreign currency equivalent) as on the last day of each month. will

Similar notices were issued by Standard Chartered Bank Pakistan Ltd, which joined rivals such as HBL and MCB in implementing the move earlier this week.

The Federal Board of Revenue (FBR) plans to impose penalties on banks that fail to meet the mandatory 50 percent ADR threshold by the end of the year. Although some banks have obtained temporary judicial relief, they argue that such taxation interferes with their supervision by the central bank.

According to one Report published by Profit“At its core, the Advance to Deposit Ratio (ADR) measures a bank’s lending activity relative to its deposits. Advances refer to lending to the private sector (businesses or individuals) and deposits are money that consumers deposit in a bank through current accounts, savings accounts, or term/fixed deposits. Banks pay interest on certain deposits (such as savings or fixed deposits) and use the money either to lend to the private sector or to invest in government securities. Ideally, a healthy ADR reflects a bank that actively lends to fuel economic activity.

According to Karachi-based JS Global Capital Ltd, as of October 25, the sector’s overall advance deposit ratio stood at 44 percent, with none of the 11 major banks meeting the 50 percent benchmark.

“Banks are aggressively meeting lending targets while discouraging large deposits to avoid higher taxes,” said Sulaiman Rafiq Manya, a Karachi-based wealth manager. “Direct disincentives are not possible, so banks are leveraging fees to limit inflows.”

The move is in line with Pakistan’s broader fiscal goals under its $7 billion International Monetary Fund (IMF) loan program, which calls for a record 40 percent increase in revenue. The banking sector is seen as a key player in achieving these ambitious goals.